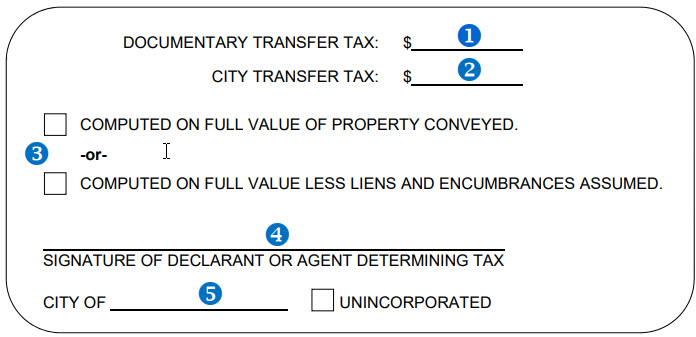

Instructions to complete the Transfer Tax Declaration

1. Enter the amount of documentary transfer tax due. The tax amount must be evenly divisible by $0.55.

Note: If the amount of tax declared is $0.00, an explanation must be provided below the tax declaration. For example:

- Gift

- Liened to full value

- Exempt under Revenue & Taxation Code § (fill in the R&T Code section)

Refer to the fact sheet on Transfer Tax Exemptions under Revenue & Taxation Code for further information.

2. Enter the amount of city transfer tax due (if applicable).

3. Check the appropriate box to indicate which value was used to calculate the amount of tax due.

4. The person making the declaration must sign here.

5. If the property is located within a city’s limits, enter the name of the city; otherwise, check the box for “unincorporated.” Cities in Sacramento County are: Citrus Heights, Elk Grove, Folsom, Galt, Isleton, Rancho Cordova, and Sacramento.